The Murray City Council has narrowly passed the first reading of an amendment to the city's alcohol ordinance that would allow sales on Sundays.

The amendment was introduced Thursday night by councilman Jason Pittman. If it passes a second reading, packaged sales, as well as liquor by-the-drink, would be allowed on Sundays from 1 p.m. until 1 a.m.

Pittman said the amendment will make Murray more competitive with neighboring cities and be good for business.

“I’ve been approached by several developers that want to come into this area," Pittman said. "I’ve been approached by several folks and establishments that are already here that would like the opportunity or the ability to sell alcoholic drinks on Sunday.”

The first reading passed with a 7-5 margin. Council members Jeremy Bell, Johnny Bohannon, Linda Cherry, Danny Hudspeth and Butch Seargent cast the dissenting votes.

Pittman said he believes the amendment will pass on its second reading in December.

“This is an issue that’s very divisive for people whenever they get right down to it and I think the folks that voted yes tonight understand the economic benefit," Pittman said. "I think they understand the potential economic impact that this has on our community and I think that’s why they levied a yes vote.”

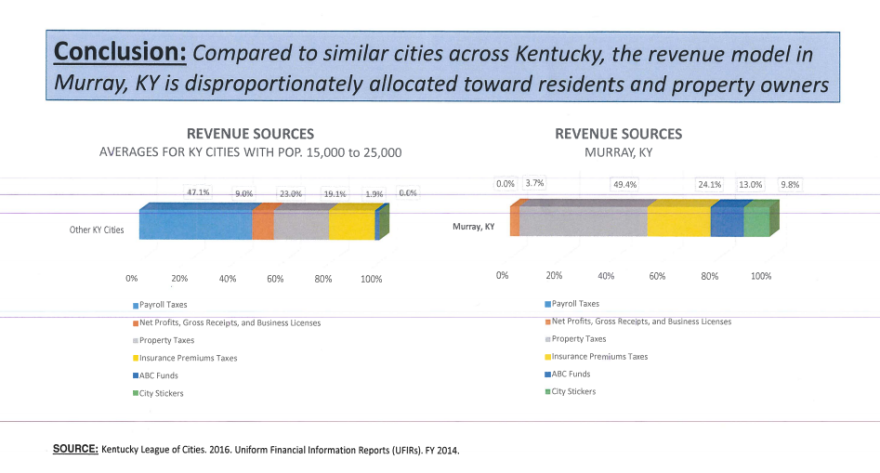

Meanwhile, as city leaders position themselves for a payroll tax vote by the end of the year, the council heard a presentation from the Kentucky League of Cities on comparative revenue data from similar communities in Kentucky.

KLC deputy executive director J.D. Chaney was on hand and concluded that Murray’s current tax portfolio is disproportionately geared toward residents and property owners. The statistics showed Murray has 69 percent higher property taxes than other Kentucky cities with public universities and 43 percent higher insurance tax rates. The data also showed that only 11 percent of Murray’s 18,000+ residents are employed within city limits.

Mayor Jack Rose said he wants any possible changes to be fair and revenue neutral.

“So what we’ll do is probably take all kinds of scenarios out of this and say, ‘How low would you want to go on the property tax? How low would you want to go on the insurance tax?’ And I think it’s a given that all of us would like to get rid of the city stickers," Rose said.

Chaney, while stressing that he wasn't casting judgment but merely providing data, told the council that Murray is the only city in the state with a population over 15,000 that relies on automobile stickers for general fund revenue. He said, on average, similar sized cities in Kentucky draw 47 percent of their revenue from occupational taxes.

Murray State president Bob Davies told WKMS last month that a payroll tax would create problems recruiting and retaining high quality faculty and staff at the university.

The council will discuss the matter further at a work meeting on Thursday, November 17.